Shares outstanding includes all shares owned by investors in a business, plus shares owned by insiders such as the company’s employees and executives. The company can sell shares up to the limit set in its articles of incorporation. Every stock that the business sells to investors becomes a share issued. Generally, share buybacks increase the value of the stocks that remain outstanding because they represent a more significant stake in the business conducting the buyback.

This can help a firm avoid the appearance of its stock being a penny stock, a class of stocks that are known for higher volatility. Many stock exchanges also have minimum prices for shares to trade on the exchange, which consolidation can help a company reach. A stock split occurs when a business divides its existing shares into multiple new shares. This keeps the market capitalization, the total value of the company, the same — while increasing the number of shares outstanding.

It includes the shares available to all investors that are free to trade in the market. It also includes the restricted shares issued to the company’s management or other key stakeholders, but it doesn’t include the shares owned by the company itself. If you need help understanding issued shares vs. outstanding shares, you can post your legal needs on UpCounsel’s marketplace.

Examples of Common Shares Outstanding in a sentence

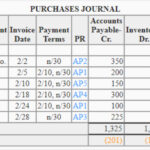

The number of outstanding shares can be found on a company’s most recent quarterly or annual filing with the Securities and Exchange Commission (SEC), usually on its balance sheet in the shareholders’ equity section. You can find the total shares outstanding in a company’s balance sheet. This includes all common stock held by the public as well as restricted shares that belong to the company’s internal management. The number of shares outstanding is the number of shares that are issued, purchased, and held by investors and company executives. First, there could be a secondary stock market offering such as a new round of outside funding or unissued shares being sold to existing investors or employees.

The formula for calculating the shares outstanding consists of subtracting the shares repurchased from the total shares issued to date. In this case, XYZ has 16,000 outstanding shares (the treasury shares are not counted). Authorized shares are the number of shares a company is authorized to issue. A company doesn’t have to issue all the shares it’s authorized to issue. The number of shares outstanding is less than or equal to the number of authorized shares.

How to calculate outstanding shares

A company’s “float” is a different measure that only considers the number of shares available for trading on the public market. You can find a company’s outstanding shares count listed under Capital Stock on the company’s balance sheet. With most companies, the number of issued shares and outstanding shares is the same. In larger companies, however, issued shares may be higher than outstanding shares for a variety of reasons including buybacks or unissued shares.

Mason Graphite Announces Acquisition of Common Shares by its Chairman and Grant of Options – Yahoo Finance

Mason Graphite Announces Acquisition of Common Shares by its Chairman and Grant of Options.

Posted: Tue, 01 Aug 2023 11:30:00 GMT [source]

This video explains several types of stocks and how they are presented in a balance sheet, including shares outstanding. The basic count is the current total number of shares; voting in the general shareholders’ meeting and dividend distribution are calculated using this number. With the IPO, the company has issued 25,800 shares, has offered 2,000 shares to each of the two managing partners, and has retained 5,500 stocks in the treasury. A share buyback is when the company buys back all its own shares from the market and takes them out of circulation. Unlike typical shares, treasury stock does not grant voting rights or the ability to receive dividends.

You’ll see the various other stock categories I’ve discussed, so don’t let that confuse you. One possible point of confusion we haven’t yet mentioned is stock given to employees as compensation, typically in some combination of restricted stock, options, or equity grants. The number of shares outstanding can fluctuate as the business indirect cost definition and meaning issues more shares, repurchases some of them, and retires shares. Companies can issue new shares and buy back shares, which affects the value of the shares they hold. Investors should track the number of shares outstanding throughout the investment period to determine how these changes impact their investment earnings.

Therefore, the company currently has authorized 5,000 shares and has 2,000 shares issued and outstanding. The purpose of the repurchase can also be to eliminate the shareholder dilution that will occur from future ESOs or equity grants. A company’s outstanding shares may change over time because of several reasons.

Motley Fool Investing Philosophy

In order to understand how to determine the number of shares outstanding, you should first learn a few related terms. An issued share is a share of stock that has been distributed by a company. New customers need to sign up, get approved, and link their bank account. The cash value of the stock rewards may not be withdrawn for 30 days after the reward is claimed. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

The outstanding stock is equal to the issued stock minus the treasury stock. Many companies elect to buy back shares as part of their capital-allocation strategy. When a company buys back its own shares, that stock is accounted for as “treasury stock” on the company’s balance sheet. Treasury stock is no longer outstanding — the company itself now owns it, not an investor or employee — but that stock has still been issued. Helpful Fool Company’s board has elected to issue just 2,000 shares at this time.

Outstanding shares are an important part of how investors calculate metrics for a corporation. In addition to market capitalization, outstanding shares can be used to calculate cash flow and earnings per share. You should be aware, however, that if you attempt to calculate earnings per share using outstanding share counts, the numbers may be inflated. Shares outstanding does not include shares held by the business, also called treasury stock. If the company later decides to sell the shares, the number of shares outstanding increases. If the firm institutes a buyback program, purchasing shares from investors, it can reduce the number of shares outstanding.

Typically, the more shares the business sells, the larger the drop in existing shares’ value. Shares outstanding only includes the shares currently held by investors. If the company later repurchases the shares it released to the public, those shares remain shares issued but are no longer part of the count of shares outstanding. Stock consolidations let a firm increase its share price without affecting existing shareholders or its market capitalization.

What are Shares Outstanding?

Market capitalization — share price times number of shares outstanding — and EPS are both computed using a company’s number of outstanding shares. The term does not include stock repurchased by the company, known as treasury shares. When the number of treasury shares increases, the total for outstanding shares declines, and vice-versa. As already stated, investors can find the number of outstanding shares on the investor relations section of the company’s website or on its balance sheet within the “Capital Stock” or “Shareholders’ Equity” section.

- This information is not a recommendation to buy, hold, or sell an investment or financial product, or take any action.

- Shares outstanding are used to determine a company’s market capitalization, i.e. the total value of a company’s equity, or equity value.

- If the company has any diluting securities, this indicates the potential future increased number of shares outstanding.

- Shares outstanding should not be confused with authorized capital, which refers to the maximum amount of shares a company is allowed to sell.

More specifically, some filers disclosed three additional zeros in one reported value compared to the other. Knowing the number of shares a firm has outstanding is significant for a couple of reasons. If a condo has six units in it, each person who owns an apartment owns a share of the building. Because there are six units, there are a total of six shares in the building as a whole. If the condo association adds a new unit, there will now be seven shares, and each share is worth a smaller slice of ownership. If one apartment is removed, then there are only five shares left, and each share becomes worth a larger portion of the building.

The second line from the bottom indicates the number of shares outstanding at the end of each fiscal year, and the bottom line indicates how many new shares were issued by Apple in that year. Total shares outstanding decreased from more than 21 billion in 2016 to less than 17 billion in 2020. The tech company spent billions buying back its stock during these years.

- If a company buys back its own stock, those repurchased shares are called treasury stock.

- When companies consider their stocks to be undervalued, they often initiate a share repurchase program, buying back some of their issued shares at a favorable price.

- The total number of shares outstanding is the number of shares that external investors, as well as insiders such as executives or employees, own.

- Shares outstanding is the total number of shares of a business that the company’s shareholders own.

- The number of outstanding shares of a company can vary greatly over time.

While shares outstanding account for company stock that includes restricted shares and blocks of institutional shares, floating stock specifically refers to shares that are available for trading. Floating stock is calculated by taking outstanding shares and subtracting restricted shares. Restricted stock are shares that are owned by company insiders, employees and key shareholders that are under temporary restriction, and therefore cannot be traded. The term outstanding shares refers to a company’s stock currently held by all its shareholders. Outstanding shares include share blocks held by institutional investors and restricted shares owned by the company’s officers and insiders.

Corporations raise money through an initial public offering (IPO) by exchanging equity stakes in the company for financing. An increase in the number of shares outstanding boosts liquidity but increases dilution. Before their availability on the secondary market, shares are authorized, issued, and, finally, purchased by investors who became equity owners or shareholders of the issuing company. Shareholders of common stock typically possess the right to participate in annual shareholders meetings and contribute toward the election of the company’s board of directors. The number of shares outstanding is also significant to know because a firm could choose to issue more stock if it has authorized more shares than it currently has outstanding. If the company decides to sell additional authorized shares, it can reduce the value of the existing shares.

Thanks to the SEC, common stock outstanding is very easy to calculate All companies are required to report their common stock outstanding on their balance sheet. Do that by navigating to the company’s investor-relations webpage, find its financial reporting, and opening up its most recent 10-Q or 10-K filing. A company may announce a stock split to increase the affordability of its shares and grow the number of investors. For instance, a 2-for-1 stock split reduces the price of the stock by 50%, but also increases the number of shares outstanding by 2x. Outstanding shares consist of every share owned by institutional investors and retail investors and restricted shares held by insiders.

المجلس العلمي المحلي الناظور بسم الله مجراها ومرساها

المجلس العلمي المحلي الناظور بسم الله مجراها ومرساها